Upon our arrival at the offices of freight and logistics company Transnet at the Port of Durban, South Africa, we were immediately put to the test with Breathalyzers before being granted entry to the restricted areas of the port. It’s not uncommon on construction sites or in manufacturing facilities where there is a lot of heavy equipment and safety is a priority to be asked to take this test, and we had been notified beforehand about it.

Once in the offices, we were warmly greeted by the Transnet staff and prepared for the beginning of our day with their customary safety briefing.

Some background on the Port of Durban: It is located on the east side of the city and is approximately 22km around the entire port. One of the few natural harbors along the east coast of Africa, Durban Bay was ideal for the early European settlers to start a trading post in the early 1800s. Dredgers were finally brought in around 1902 to deepen the natural harbor to accommodate ships into the newly created port. An extensive rail network was soon created to link the port to other key cities inland and along the coast to other port cities. It is also home to three marinas with various yacht clubs and the cities first beach.

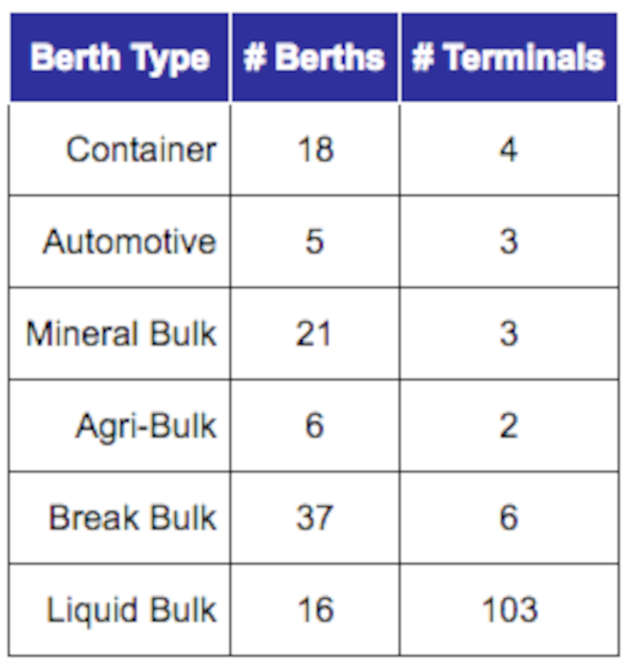

After brief introductions, we were provided with an overview of the port and of Transnet, which is a Government-Owned Entity (GOE). We visited with the TPT division of Transnet, which is primarily responsible for the movement of all freight cargo within the port. Transnet is structured into five main divisions that collectively make up 25.6 billion rand in earnings before interest, taxes, depreciation and amortization (EBITDA), with TPT contributing 11 billion rand. Transnet provides employment for more than 50,000 people, moves more than 80 tons of cargo every year and manages 58 berths within their area of responsibility.

We learned that the downturn in the global economy has had an adverse impact on Transnet, specifically in three primary areas. These challenges are shared by the entire industry and have helped knocked Durban out of the Top 50 World Container Ports listing.

- They have seen a 50 percent reduction in service calls due to carrier and line consolidation, an industry trend that shows no sign of reversing.

- The drop in global commodity prices has a direct impact on port activity and volume, negatively affecting the amount of raw materials being exported from South Africa.

- A sharp drop in the South African rand-to-dollar exchange rate has had a strong impact on the manufacturing industry, which in turn cascades down to shipping, importing and exporting.

TPT’s growth strategy to combat these new challenges is three-pronged:

- Defend and grow their domestic market share through investments in infrastructure, technology, capacity increases, and cost reduction and optimization.

- Focus on supply chain integration with a focus on inland operations.

- Global expansion, primarily in the southern, eastern and western African regions.

Operations occur across two piers, each employing different approaches to moving cargo and freight. The older Pier 2 terminal primarily uses the RTG lifts that are highly mobile and able to stack containers as much as six high. The RTGs chief disadvantage is not being able to operate during high wind conditions. The newer and more modern Pier 1 terminal primarily uses the Straddle lifts that are capable of moving several containers at a time very quickly but cannot stack the containers as high as the RTGs.

Managing and controlling the movement of all the freight is done through their enterprise logistics system called Nevus. They have been able to automate much of the management processes for moving their freight through both Nevus and optical camera operations that take pictures of each container and truck as they drive through the camera wells, eliminating the inefficient paperwork required before.

Minimizing vessel turnaround time is a key performance metric to measure the operating efficiencies of port operations. These are measured with two key indicators:

- Gross Crane Hours (GCH), where single crane performance is measured; and

- Ship Working Hours (SWH), where the performance of all cranes is measured.

One key constraint that has inhibited performance of the port is its unique “Z” design, which makes navigating ships in and out of the harbor more challenging and slow.

Transnet has two projects in the immediate pipeline, both of them infrastructure projects to expand and optimize operations:

- North Quay Extension – Expanding and making the north quay larger and more accessible

- New Salisbury Island Infill – Filling in a substantial area currently covered by water to make better use of it for temporary container storage.

Other focus areas for improving Transnet’s position in the market and gaining additional competitive advantages are through innovation strategy and R&D in making company terminals more intelligent and automated. The Smart Port Cities initiative with the city of Durban as the pilot program is an important step in the implementation of this strategy.

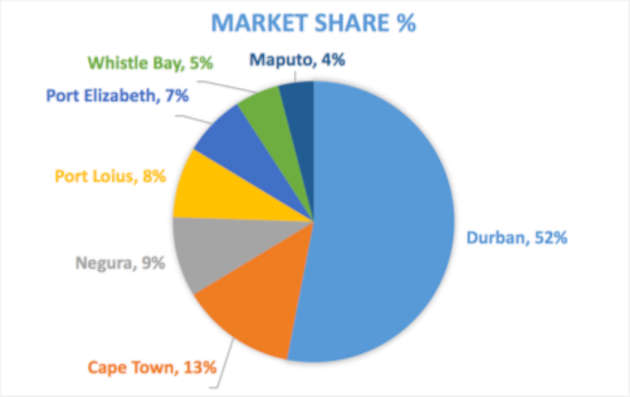

The competitive landscape is an interesting mix. Being a GOE, Transnet effectively enjoys a virtual monopoly on the container-freight-movement industry sector. Other sectors of freight movement are more competitive, with Transnet having a 48 percent market share in the break-bulk market segment.

Competition with other South African ports exists as well, with many other ports beginning to increase their capacity and increase their market share. Cape Town, in particular, is in the process of increasing its capacity from 200,000 TU 750,000 TU, and Maputo is coming online with capacity of 100,000 TU.

Read the first post about the EMBA Class of 2016 international study tour to South Africa: EMBA Class of 2016 Trip to Shakaland.