Ah, the ever exciting business structure discussion. Is there a business topic more exciting? Could watching paint dry draw a larger crowd than the intricacies of LLCs? Let’s attempt a somewhat more exciting and incredibly less academic viewpoint of business structures.

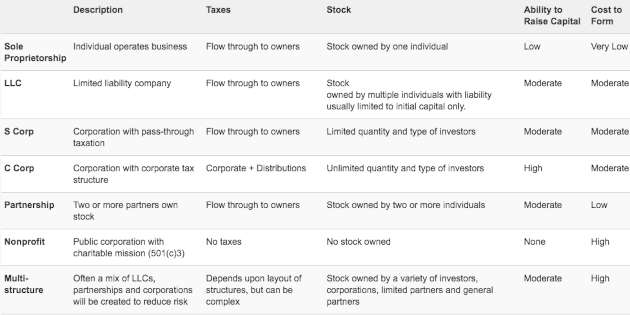

I am, however, obligated to at least detail what each structure looks like, but I’ll do so in the least painful way possible…a chart!

A few things you’ll notice in the chart above in the complexity of business structures is that there is not one perfect (hence the options) structure that supports your needs best. For instance, if you desire to build a business that you and your family will own and operate for many years, what type of structure would you prefer? You may want to start that business as a partnership or sole proprietorship until you get the business off the ground. This limits your costs and time to start. As you grow your business, you should consider converting the business to an S Corp or an LLC.

If the desire is to never raise venture capital, an LLC will work well and should be an easy conversion. This allows the business to continue its existence longer than a partnership. An LLC also enables you to create some creative capital distribution clauses in the formation, including paying back startup capital with initial distributions, then reverting to paying profits by percentage of ownership.

Let’s take another business idea through the same process. Your new idea consists of developing software that has a large market and the ability to exit by merger-and-acquisition in the next five to 10 years. You are early in the process of developing the idea and software, but you have the capital to get most of the development complete. You may want to begin by creating an LLC in order to allocate stock to your co founders. This structure will allow you to raise some “friends and family” money or perhaps angel money, depending upon how you raise it (group vs. individual).

Now that you’ve developed the product and are ready to launch, you will need money from larger investors. At this point you should strongly consider converting to a C-Corp. Each investor is different, but many (especially venture capitalists) prefer a C-Corp in order to allocate preferences and stock classes to themselves and other investors.

We haven’t touched on nonprofits yet, but I believe it is important to understand their importance. A nonprofit can be a brilliant way to launch a new business if the ultimate outcome is not about “profits” or “selling a business.” If the objective of your business has social or religious merit, a nonprofit structure may work well. Just because it says nonprofit doesn’t mean you can’t operate like a business. You just can’t pocket the profits!

It is also important for me to distinguish between a ‘nonprofit’ and a business that ‘does good while making money’. Many socially conscience or religiously valuable organizations are popping up that have a strong core mission of helping and doing good things, but ultimately still make a profit. While it is a thin line to walk at times, this model has a tremendous growth curve as seen by companies such as TOMS shoes. Keep in mind that your investors and customers have expectations associated with your mission.

Ultimately, speaking with an attorney and/or accountant will help you to understand what is best for your business, and they can detail the tax implications much more so than I did above. They should be your partners and trusted advisers on all things legal. Check out legalzoom.com and venturedocs.com to learn more about structures and fundraising documents.

I did promise that this would be exciting, and I hope I haven’t let you down too much. I was excited to write about business structures (did I say that out loud?) because I feel that building a strong business and infrastructure around your idea are almost as important as the business itself. If you make a mistake on the front end, it could affect your wallet in the future.

Let me close by recommending that you learn from others’ mistakes. Research every decision you make and speak to professionals. Talk to others in your city or networks that have gone down a similar path as you.