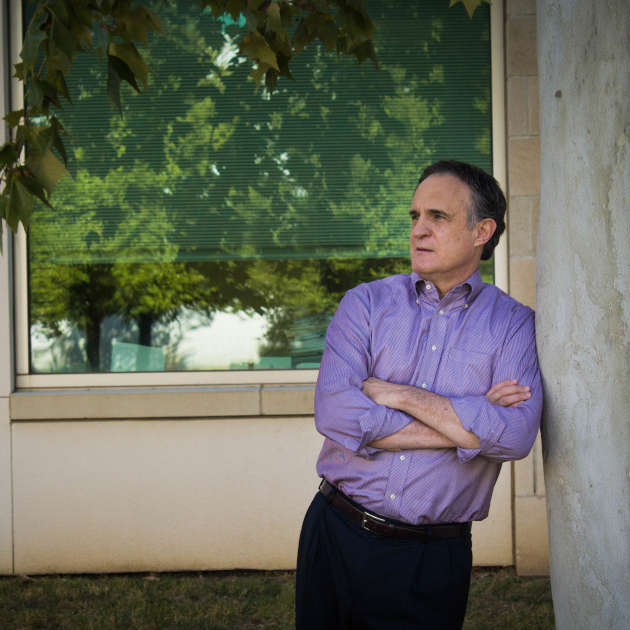

John Gamino, an accounting assistant professor who specializes in taxation issues, examined the growing business of third-party litigation funding in research that recently won an Outstanding Paper Award from the American Taxation Association.

The ATA is a special interest section of the American Accounting Association, a professional group for accountants in academia. Gamino was recognized during the association’s annual meeting in Chicago in August. His work, “Taxing Nonrecourse Litigation Funding,” appeared in the December 2014 issue (Volume 2, Issue 2, pages 85-104) of the Journal of Legal Tax Research.

An editorial board reviews articles in contention for the award “for relevance, contribution and value,” Dr. Anthony Curatola, editor of the journal, said. “John’s paper had the most number of voters for best and second-best article of the year. This is quite an accomplishment.”

At its core, litigation funding involves bankrolling legal actions. Companies advance money to plaintiffs in civil lawsuits before the suits go to court. In exchange, those companies share in any cash settlement or resulting judgment. The “nonrecourse” in the paper’s title refers to the fact that these arrangements are made on a contingency basis; companies that provide advances recover nothing — have no recourse —if the plaintiffs do not reach a cash settlement or win money damages.

“Largely unregulated, litigation funding began with the consumer market — that is, with personal injury actions and other relatively small-dollar cases involving individual plaintiffs,” Gamino wrote. “Over the last decade, however, the commercial market has expanded significantly, with funding transactions finding a place in high-stakes business litigation, including patent infringement, breach of contract, shareholder derivative suits, and more.”

Observers agree it is hard to place a value on the litigation-funding industry in part because regulation is scant, and in part because litigants, lawyers and funders like to keep terms of their agreements private. An oft-cited 2011 figure from the New York City Bar Association estimated the outstanding aggregate amount of litigation financing in the U.S. at that time to be in excess of $1 billion.

Although risk is involved, companies that become cash-in-advance providers are motivated to continue, Gamino wrote, because their return on investment when the plaintiffs they back are successful is substantially more than returns they can make in traditional lending scenarios. (Viewed from the plaintiffs’ prospective, though, Gamino noted, the successful plaintiff who has taken an award in advance “may realize a markedly diminished net cash recovery.”)

As a tax specialist, Gamino’s concern with the commercial side of litigation funding is that the Internal Revenue Service has neither acknowledged the existence of the third-party advances nor offered administrative guidance for income tax issues that arise from them.

Despite funding providers’ claims that these cash advances qualify as investments or asset purchases, Gamino maintained in his article that they amount to loans. He recommended that for federal income tax purposes, the IRS should treat all commercial litigation-funding transactions as loans, and he included a proposed two-question IRS ruling that funding providers could use to quickly determine their status.